The firm says that Lush’s UK sales enjoyed 13% growth in the year leading to April 2018, which outperformed the UK health & beauty market’s 2.9% growth.

“Despite being a well-established retailer in its market, the company has used product innovation, such as its charcoal collection, to attract a new demographic to its stores and retain existing customers,” says GlobalData.

Younger consumers: retaining their interest

GlobalData suggests that the beauty company, which markets itself as an ethical player and engages in social and political campaigns, is enduringly popular with younger consumers.

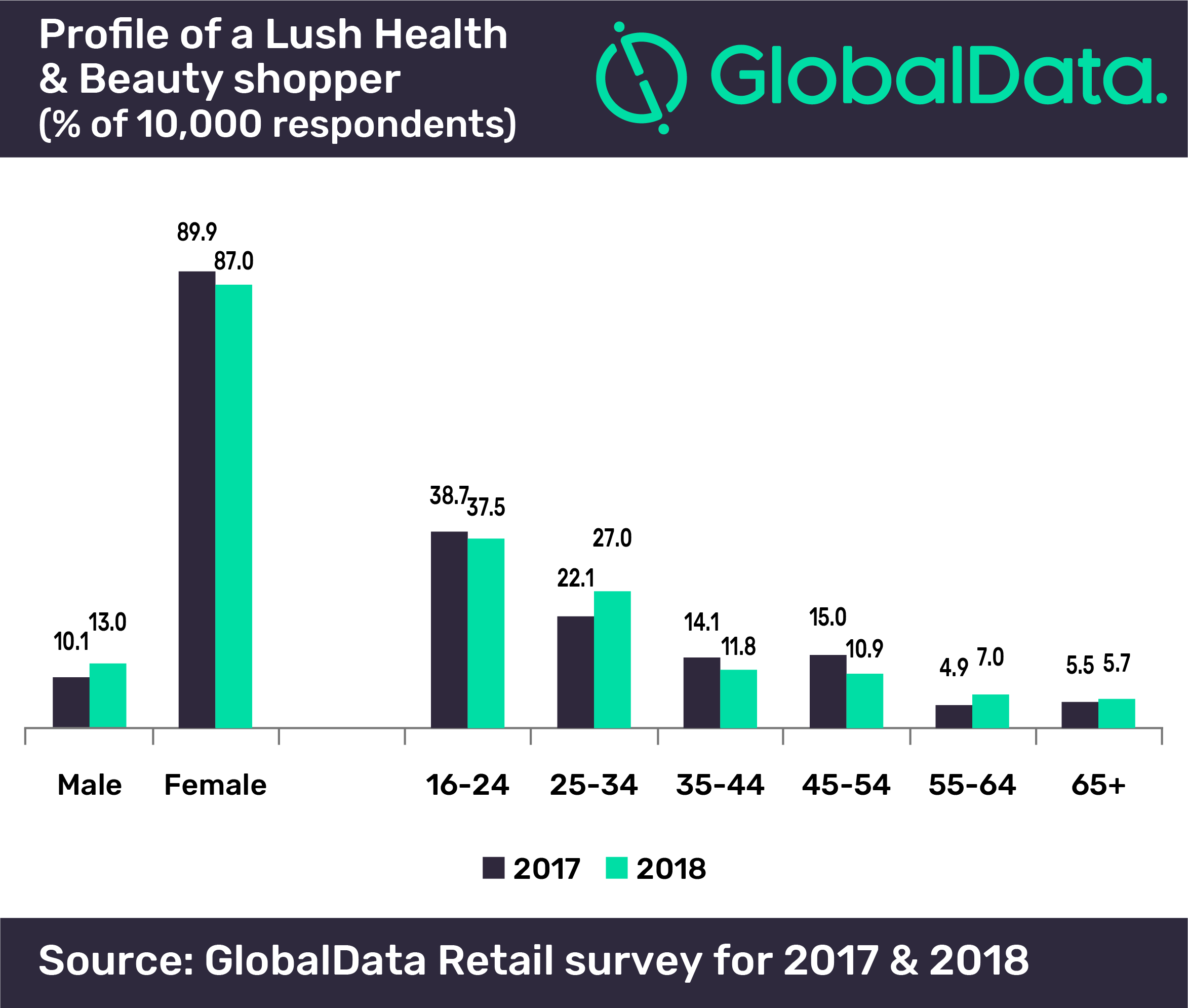

Zoe Mills, Retail Analyst at GlobalData commented, “The brand has been successful in retaining its core customer – females aged 16-24.

“Lush’s iconic bath bombs are its standout product that appeals to millennial shoppers, generating a cult following and helping to establish its reputation in the beauty market as a fun and unique retailer.

"This, alongside its extensive range of exclusive products has allowed Lush to differentiate itself from market leaders such as Boots and Superdrug.”

Loyalty up

On top of this, in a sign that Lush is particularly strong at appealing to customers longer term, it is also successful with the 25-34 year old category of consumers.

“With 25-34s accounting for 27.0% of Lush shoppers in 2018, customer loyalty has ensured that it has retained its shoppers as they have grown up,” says GlobalData.

“Lush has also encouraged new consumers in this age group through new cult products that are often featured in the press, highlighting that Lush is at the forefront of innovation and that it can adapt to the latest trends to widen its appeal to beauty-product enthusiasts.”

Lush has also widened its reach to older consumers, with a larger proportion of 55+ shoppers, says the research firm.

This can be attributed to the fact that more of Lush’s products are perceived to have health benefits, attracting shoppers who would not normally consider shopping at the brand, particularly as we are seeing a blurring of the separation between beauty and wellbeing.

For example, customers have claimed its Dream Cream alleviates skin conditions such as eczema, according to GlobalData, driving a surge in sales of the product this year and leaving the retailer with stock shortages across its store estate.