The last three years have been one of the most difficult periods for the colour cosmetics market since makeup maestro Max Factor brought makeup from the big screen and into our everyday lives.

The daily ritual of waking up to and putting your best face forward suddenly became redundant as we all went into isolation because of COVID-19. Possibly for the first time ever, there was no need to put on makeup.

From April to June 2020, the Estée Lauder Companies saw makeup sales plunge by a whopping 61%. The decline in makeup sales were seen across the board. According to the 2020 beauty giant L’Oréal, colour cosmetics recorded a 21% decrease in sales in 2020.

Certainly, sales of makeup declined, but they did not diminish completely. Brands such as Liht Organics and Orcé Cosmetics recorded a surge in demand for their makeup, taking its even its owners by surprise.

Despite a global crisis and despite having no places to go or people to see, consumers still wanted to put on some makeup. The reasons why are plenty and valid. For some it added a sense of normality to extraordinary circumstances. For others, a little swipe of lippie could give a huge emotional boost during a trying time.

While not classified as an essential item, the pandemic underlined the significance of makeup and its emotional connection to people that goes beyond the cosmetic.

When we finally emerged from confinement, makeup continued to be hindered by the mandatory use of protective face masks. L’Oréal’s financial data showed that nearly all its categories except makeup had recovered back to 2019 levels by early 2022.

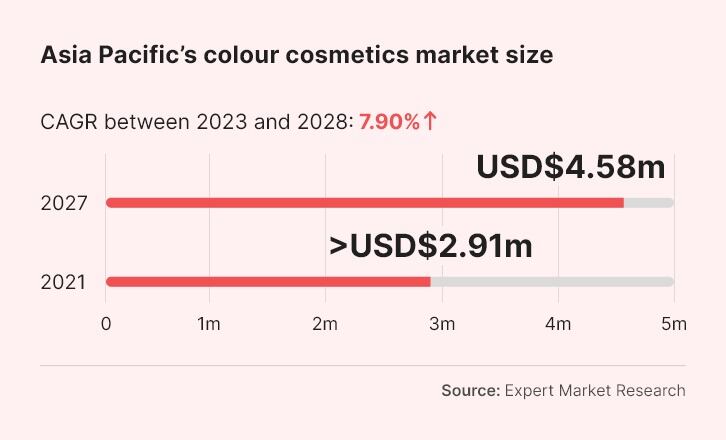

The recovery of makeup, especially in Asia Pacific, was delayed further by China’s strict COVID-19 restrictions, which gradually ended by start of 2023. As of publishing, most countries in APAC – including China – have mostly lifted mask mandates, ending a prolonged period that has severely impacted the colour cosmetics market.

The end of the mask-on era has undoubtedly been an exciting moment for the APAC beauty market, as now makeup can finally begin its recovery in earnest – especially with the comeback of lipstick.

“The makeup category is on a big rebound with work back to office, travel opening up, and a rise in social engagements. Lips is driving a large part of the growth,” said Manashi Guha, South Asia Pacific, Middle East and North Africa (SAPMENA) General Manager, Consumer Products Division, L’Oréal.

However, like every aspect of our lives, the pandemic has not failed to leave a lasting influence on the colour cosmetics category. As people adapted to the new normal, the change in lifestyles and behaviour led to a shift in beauty routines and makeup trends.

Colour with benefits: Makeup’s ‘skinification’

Over the past three years, health has been one of the biggest priorities and we have seen consumers approach health in a more holistic manner. This has significantly impacted the beauty across all categories, including makeup.

“The pandemic has shifted beauty consumption habits towards healthier and more sustainable choices. Beauty is increasingly intertwined with health and wellness. Consumers want safety, efficacy, and transparency from brands,” explained Guha, who oversees brands such as L’Oréal Paris, Maybelline New York and NYX Professional Makeup.

“While this has been the case in skin care, it is influencing our choices in makeup with consumers desiring ‘skinification’ – incorporating skincare benefits into makeup and hair products.”

She elaborated that this been driven strongly by the digitalisation of beauty. “An online experience is at the heart of this shift from beauty care to healthy beauty with ingredient and scientific information, reviews, and recommendations available at our fingertips.”

This has influenced the company to develop products like Maybelline’s Fit Me Fresh Tint, which incorporated sun protection and infused with vitamin C to brighten the look of skin.

“What we are noticing is that consumers are now paying more attention to their complexion and the texture of their skin, rather than just covering it,” said Shih Yu-Chen, founder and CEO of Orcé Cosmetics.

Orcé is best known for its Skin Perfecting Serum-Foundation, which contains ingredients such as hyaluronic acid, Tahitian pearls, and evodia rutaecarpa extract. The brand claims that these ingredients can help to plump the skin, reduce hyperpigmentation, stimulate collagen production, protect against environmental stressors, and more.

“It’s a bit bold but we like to say we were one of the original serum foundations. We talked about skin care benefits in foundation when people weren’t looking for one. Today, consumers are looking for products that can do both,” said Shih.

As the demand for such hybrid products grow, Shih believes it will get easier to develop and produce product that can meet this multifunctional demand.

“When we started formulating back in 2017, it was tough to find a chemist that not only do skin care, but colour as well. A lot of chemists tend to specialise in one or the other but in recent years, we’re seeing more chemists moving out of their comfort zones because of how the market is going and there’s more demand for products that essentially marrying both in one.”

Shih revealed to us that the brand is set to introduce more products this year that all follow this concept.

“We are about to relaunch our foundation with new packaging and more inclusive shades. We are also working on some exciting colour products as well that’s not limited to lip, eye, cheeks, highlighters, and bronzers. We’re also working on a tinted sunscreen and concealer. What all our products will have in common is that they will be skin care-makeup hybrids. Even if its as simple as an eyeshadow colour, it will have skin care benefits.”

In addition to demanding more skin care benefits from their makeup, consumers are also changing their preference for textures.

Shih has observed more appreciation for sheer textures, a change that is more noticeable in lip products. “With lipsticks, people are looking for a balm texture, rather than the heavy, and matte textures that we were used to.”

This shift has also been observed by colours supplier Sensient.

“Because of masks, the trend was more about matte lipsticks. It had to be non-transfer and waterproof. I think consumers are fed-up with these and are looking for something more nourishing – they want to let their lips breathe,” said Marianne Peltier, managing director, cosmetics Asia, Sensient Beauty.

She expects glossy and balmy textures to dominate the lip category for the foreseeable future. Trends such as glitters and pearls are also expected to show up on the market.

The challenge for cosmetic companies today is developing products that appeal to sensory demands of the post-pandemic consumer while meeting conventional concerns such as longevity.

Naturality and sustainability in makeup

On the other hand, India’s Juicy Chemistry suggested that claims like long-wearing colour, may not be as important to consumers anymore.

“One of the very key findings that we found was that consumers are actually okay not using very long-wearing makeup. They are not asking for more than eight hours and they don’t want to damage their skin,” said Pritesh Asher, co-founder and CEO of Juicy Chemistry, which launched its organic Color Chemistry makeup range late 2022.

He elaborated that the today’s consumers have more important concerns on their mind.

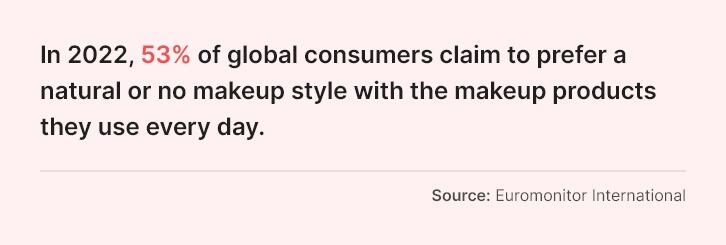

“Today’s consumer is looking for comfort above anything else. It’s just like what happened with clothing and loungewear. People may not want to put on heavy and cakey makeup, they just want to feel like themselves.”

He added that this is also being driven by ongoing inclusivity movement. “They want makeup to be an expression of themselves. It’s about making them look as natural as possible rather than make them look like somebody else.”

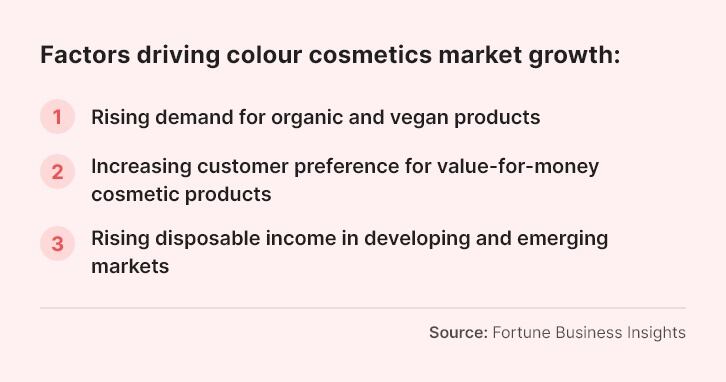

This more relaxed approach to makeup is fuelling the demand for natural and organic makeup products, said Asher.

“There is a huge scope for organic makeup. Not just in India, but in the world as well. People are prioritising their health more than just thinking about being Instagram ready, for example. It's the long-term investment in yourself has taken precedence.”

While Juicy Chemistry expects organic makeup to increase in popularity, Asher noted that the industry needs to step up in terms of ingredient innovation.

“There are limitations when you go with organic formulations, there’s no doubt about it. Like with lipsticks, it’s a serious challenge to get that red colour organically without carmine,” he said.

“As a brand that does not endorse any product that comes from animal origin and serves a huge vegetarian and vegan consumer base here in India, avoiding it is definitely a challenge. Innovation in this area definitely needs to step up to include more options of formulators.”

In addition to more natural and organic ingredients, the sustainable beauty movement is calling for more eco-friendly packaging solutions.

The Body Shop recently re-vamped its makeup category with a new collection of cruelty free, vegan and makeup. The new collection also has recyclable packaging materials and refillable options for items like its Peptalk Lipstick.

“It’s a super sustainable lip colour with a container sold separately from the refill bullet. From the feedback, people really love the colour range and its super moisturising as well. But it’s also very relevant to people who want to be sustainable,” said Felicia Sun, head of brand and activism, The Body Shop.

“The global move to solve the ongoing climate crisis is having a nascent but growing momentum and interest in sustainability in SAPMENA markets, with many governments taking a stand on the topic. Consumers, especially the youth, are gravitating towards more sustainable product choices – ingredients, packaging and disposal,” said Guha.

L’Oréal itself is a founding member of the EcoBeautyScore Consortium, with some 30 beauty industry players that are working together to develop an industry-wide environmental impact assessment and scoring system for cosmetics products.

“The aim is to provide consumers with clear, transparent, and comparable environmental impact information, based on a common science-based methodology, in areas such as formula, packaging and usage,” said Guha.

Virtual expectations

In previous instalments of this series, we explored how the recent developments in digitalisation has changed how we shop for cosmetics and how it has impacted other categories like fragrances.

Today, more than 60% of beauty consumers buy online every week, said L’Oréal. And beauty is among the top categories bought online, after mobile phones and fashion.

“With digitalisation, makeup – and in fact all beauty – are at our fingertips. In SAPMENA, 43% of the total population is younger than 25 years – our consumers are young and totally connected. They choose brands that reflect their vibrancy and values, and most of their interaction with brands is digital,” said Guha.

“The rapid growth of social media platforms and adoption of social commerce – alongside the development of better connectivity through 4G and now 5G networks – has sparked and sustained the need to offer consumers live, interactive, immersive experiences from brands, their ambassadors and beauty influencers on platforms like TikTok. These platforms rely on new functionality to engage consumers and make it easier for them to buy with a single click.”

Makeup, with its colour and artistry, is a naturally idea fit to creating engaging digital content.

“Makeup is a very visual product and is especially popular with influencers and their followers on social media, who are typically a younger, and digitally connected audience eager for new experiences,” said Guha.

Guha highlighted the launches of Maybelline’s Sky High Mascara and Superstay Vinyl Ink, which capitalised on the popularity of TikTok to generate excitement on the launches.

“The launch of Sky High mascara by Maybelline New York created an unprecedented buzz on social networks, with over 300 million views on TikTok, thanks to the participation of a diverse array of opinion leaders, from budding influencers to social media superstars. And the success translated to sales: first on Sky High and then on Vinyl Ink,” she said.

Additionally, the company has invested in technology such as AI- and AR-powered virtual try-on (VTO) applications to allow consumers to experiment and find what best suit their needs easily.

“In Maybelline New York – our makeup brand targeted at Gen Z and Millennials – the new consumer experience is through VTOs. In SAPMENA, we have over 50 million virtual try-ons for makeup in a year. E-beauty advisors provide consumers with virtual assistance when they visit our e-stores,” said Guha.

There is a sense that beauty is expanding on itself and with young consumers, gaming and meta-worlds were the “new buzzwords” to explore, said Guha.

“In 2022, Maybelline launched a range of co-branded SuperStay Free Fire lipsticks where you can have your avatars wearing the same lipstick as you. In Australia, we engaged in a partnership with Fortnite, a popular global game.

“To promote authenticity, inclusivity and creativity for self‑expression in the metaverse, L'Oréal premiered virtual beauty looks in November through the first ever multi-brand beauty partnership with leading cross-game avatar platform Ready Player Me. Maybelline New York and L'Oréal Professionnel provide exclusive makeup and hair styles for avatar creation, which can be used on more than 4,000 platforms and apps worldwide.”

Changing faces: Makeup disruptors

In late 2021, Singapore-based nail wrap brand Nodspark added magnetic false eyelashes to its product portfolio. Lashes On Demand started out as an experiment but took off rapidly to the company’s surprise.

“Right from the start when we launched, it would sell out so fast. We had so many backorders and the return rates are quite decent,” said founder Eugenia Ye-Yeo.

With false lashes proving to be such a lucrative category for the company, Nodspark is set to expand its line-up with a new product.

“We’re going to be launching a different style of lashes soon. Instead of magnets, it will have an adhesive that is in the form of an eyeliner as well. We also have a clear eyeliner for customers that want a very natural look,” said Ye-Yeo.

The popularity of Nodspark’s false lashes is being driven in part by the popularity of semi-permanent beauty procedures.

These procedures, which include eyelash extensions and semi-permanent eyeliner and lip liner have seen a significant rise in popularity in recent years as they are becoming increasingly accessible for those seeking to enhance their natural features with a long-lasting yet low-maintenance option.

“If there’s a safe option with a good price point and all the regulations in place, I definitely think people will go for it. Especially in place of more invasive treatments [like fillers] which are becoming more popular,” said Ye-Yeo.

These semi-permanent procedures as well as products like Lashes on Demand could pose a threat to conventional makeup products. In this instance, the product that could be at risk of becoming obsolete is mascara, especially in hot and humid regions like South East Asia.

“Mascaras are just such a hassle. Some mascaras give you very clumpy lashes and you have to find one that doesn’t smudge with your oily eyelids. And there’s removal, which is the hardest part. Sometimes it gets into your eyes during removal. There are just so many problems. I don’t think mascara is a very popular option now because of all the other options available,” said Ye-Yeo.

Semi-permanent procedures are also driving beauty tech innovations that could potentially change the makeup category drastically.

In January, L’Oréal debuted Brow Magic at the 2023 Consumer Electronics Show (CES) in Las Vegas. Brow Magic was a handheld machine that prints non-permanent eyebrow tattoos directly onto the face.

"Using 2,400 tiny nozzles and printing technology with up to 1,200 drops per inch (dpi) printing resolution," Brow Magic can give consumer picture perfect brows in a matter of seconds. This brings us to the exciting possibility of devices that can apply blush, eyeliner, and eyeshadow, helping consumers ‘print’ entire makeup looks faster than we can smear on some blush.

The makeup market has seen significant changes since the COVID-19 outbreak, reflecting the evolving needs and preferences of a diverse consumer base. This includes the demand for clean and sustainable beauty products and the impact of these products on personal health and the environment.

At the same time, brands must find ways to integrate technology into their product offerings and marketing to keep with the digital-first generation.