Key takeaways on Puig’s record growth in 2025

- Puig achieved record sales of €5.04bn in 2025, surpassing its strategic revenue goals

- The CEO expects fragrance category growth to “normalise” in 2026

- Strong Q4 performance, especially in colour cosmetics

- Carolina Herrera, Rabanne and Jean Paul Gaultier remain global top‑10 fragrance brands

- Asia-Pacific delivered standout growth across makeup, niche and derma

- Spanish luxury beauty and fashion company Puig recorded sales of €5.04bn in 2025, up 7.8% on a like‑for‑like basis compared to 2024.

Marc Puig, Chairman and CEO of Puig, said the business had outperformed the general market. He also noted that Puig had completed its previous five‑year strategic plan, communicated in early 2021, which set its ambition to double its 2020 revenue in three years and triple it in five. “We exceeded those goals, more than doubling our revenue by 2022 and more than tripling it by 2025,” he said.

However, Marc Puig issued a word of caution for the fast‑growing fragrance category, stating that he expects growth in the fragrance market to “continue to normalise” and therefore not maintain its recent upward trajectory.

Looking ahead, Puig said the business was entering the new financial year with confidence. “Given the strength of our brand portfolio and our steady pipeline of innovation, we are well placed to sustain healthy growth and continue to outperform the premium beauty market,” he stated.

In Q4 2025, often dubbed the ‘golden quarter’ in retail, Puig delivered like‑for‑like growth of +9.8%. The company also reported a standout performance in makeup.

The business’ largest segment, Fragrance and Fashion, accounted for 72% of Puig’s net revenue in FY2025. It generated €3,646 million in net revenue, with like‑for‑like growth of +6.4% for the full year.

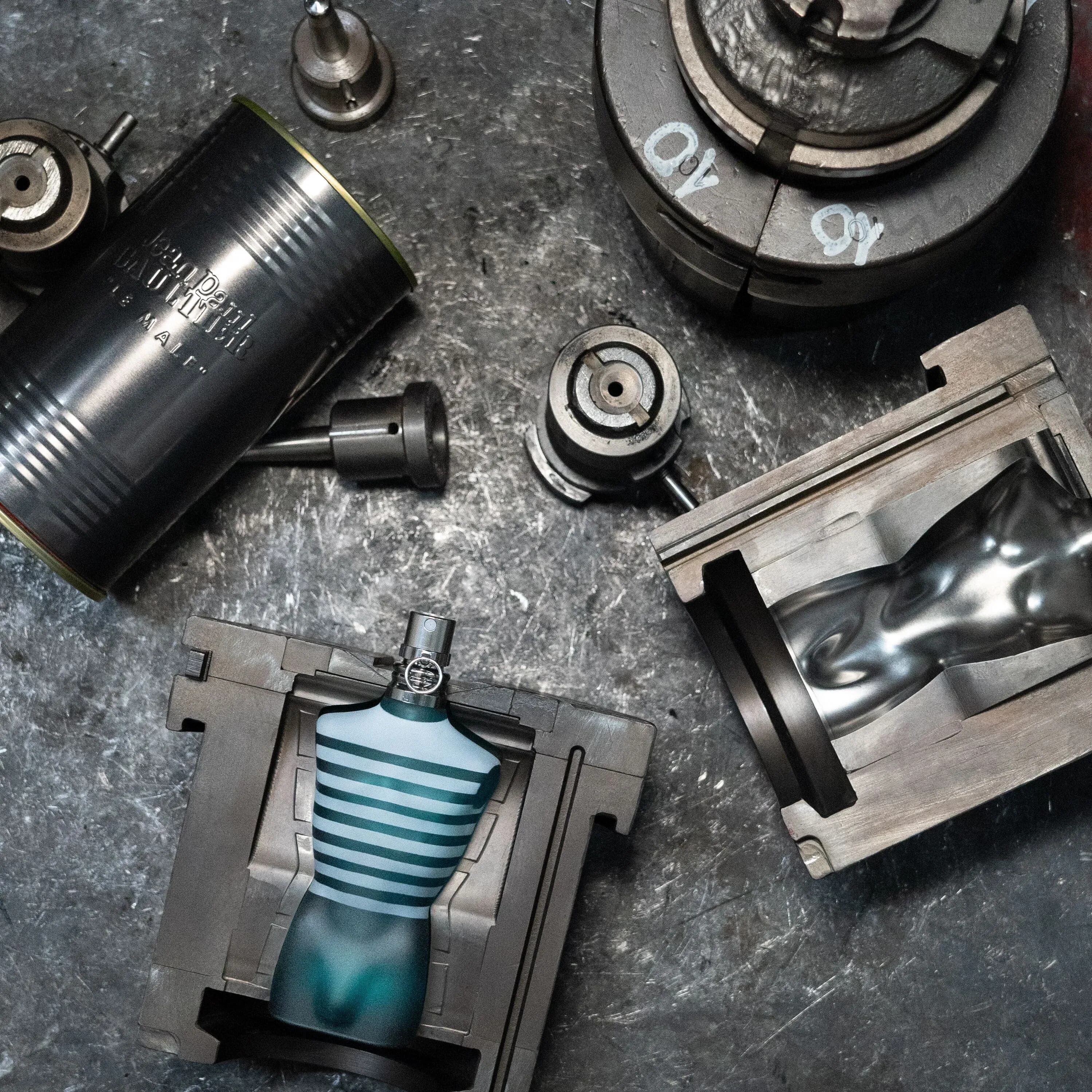

The best-selling scent brands were Carolina Herrera and Jean Paul Gaultier. Puig also reported double‑digit growth across its niche portfolio, led by Byredo.

Puig also said that three of its fragrance brands – Rabanne, Carolina Herrera and Jean Paul Gaultier – continue to rank among the top 10 best‑selling fragrances worldwide.

Makeup and skincare deliver strong Q4 performance

The business’ largest makeup brand, Charlotte Tilbury, recorded a strong performance compared to 2024. It also maintained its number‑one prestige makeup ranking in the UK and number‑three position in the US.

In Q4, Puig’s colour cosmetics brands generated net revenue of €276 million, achieving +26.5% like‑for‑like growth.

Skincare delivered €551 million in sales, representing 11% of Puig’s net revenue in FY2025, with like‑for‑like growth of +8.9%. Derma brand Uriage saw double‑digit growth, while skincare generated €141 million in net revenue in Q4 alone, delivering like‑for‑like growth of +7.9%.

Regional markets show mixed results amid currency pressures

The EMEA region accounted for 55% of Puig’s net revenue in FY2025. It generated €2,752 million in net revenue, with sales up +5.5% on a like‑for‑like basis for the year.

The Americas represented 35% of Puig’s net revenue, generating €1,760 million and delivering like‑for‑like growth of +7.7%. However, foreign exchange movements negatively affected performance, primarily due to the US dollar and emerging market currencies in Latin America.

Asia-Pacific represented 11% of Puig’s revenue, generating €530 million and delivering like‑for‑like growth of +21.7%. The region experienced strong sales across Charlotte Tilbury, niche fragrances and derma.