Key takeaways

- Generative AI is becoming the first touchpoint for beauty product discovery.

- Revieve’s AI Beauty Discovery Connect gives brands control in AI environments.

- Early adoption of AI-native strategies will define future beauty engagement.

- Personalisation and transparency are critical as consumer expectations rise.

Beauty tech company Revieve has launched AI Beauty Discovery Connect, a new technology that enables beauty brands and retailers to integrate their personalised experiences into Generative AI platforms such as ChatGPT and Google Gemini.

Generative AI is redefining beauty product discovery

The business noted that this creates a new retail touchpoint where consumer inspiration begins, while keeping brand identity and data integrity.

The move comes as commerce shifts towards AI-native interactions, with major players like Walmart, Google and PayPal enabling shopping and payments through AI agents. According to McKinsey, over 25% of US consumers already use Generative AI for product discovery.

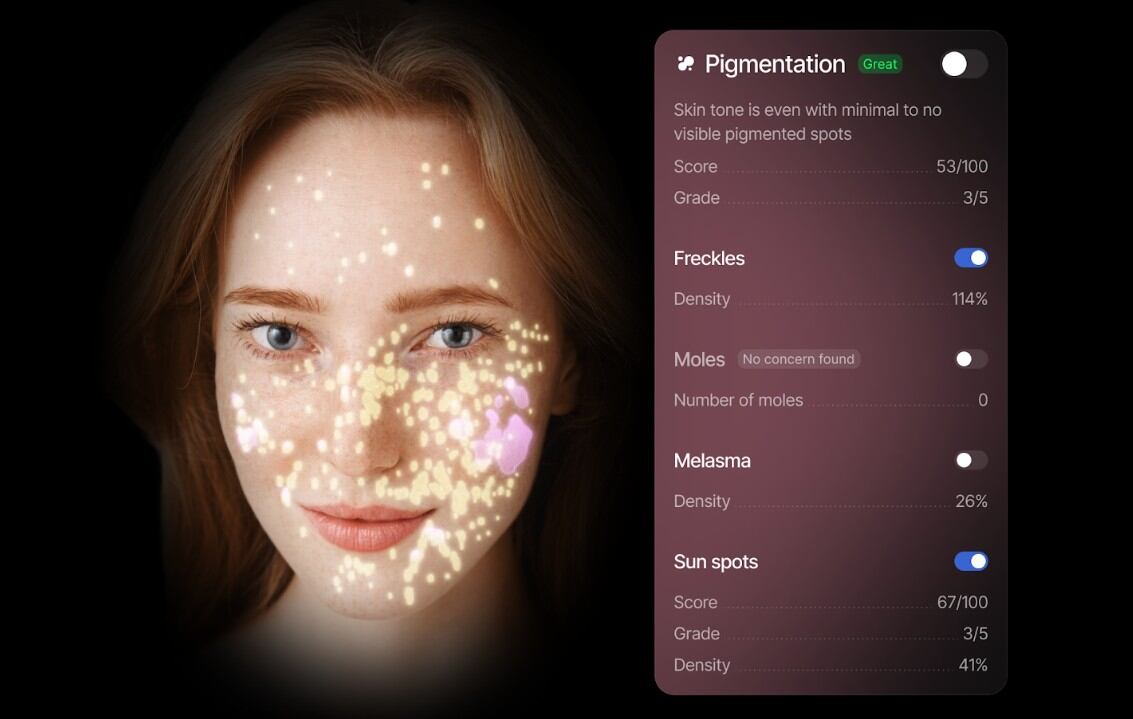

Revieve’s solution bridges brand-owned personalisation, retail media networks and AI-driven discovery, ensuring accurate product recommendations and shoppable experiences across conversational AI platforms. This innovation positions beauty brands to meet rising demand for expert-like, personalised digital experiences and prepares them for the next era of AI-powered engagement.

Why brands must build an AI-native presence

According to Irina Mazur of Revieve, Generative AI is quickly becoming the new first touchpoint in beauty.

“For many consumers, product discovery now starts with a question inside ChatGPT or Google Gemini rather than a search engine or a retailer’s website,” she said. “That shift fundamentally changes where discovery happens, who frames the options, and how trust is built. Conversations replace feeds and shelves, AI becomes the guide instead of traditional merchandising, and what truly matters is no longer reach but relevance, transparency and accuracy.”

Mazur said that up until now, beauty brands have had almost no control over how they appear in these AI environments — if they appeared at all — but she believes that AI Beauty Discovery Connect changes this dynamic.

“It allows brands and retailers to bring their own product data, routines and education into the AI experience so that when a consumer asks, ‘What should I use for my skin?’, the response is anchored in real brand intelligence rather than a generalised or incomplete answer,” she explained.

In the near term, Mazur said this creates an entirely new layer of discovery and conversion on top of existing e-commerce and retail media.

“Looking ahead, we believe every leading beauty brand will need an ‘AI-native’ presence, just as they once needed a website or a social strategy. Those who move first will help define what responsible, high-quality beauty advice looks like inside AI and ultimately shape the future of how consumers discover and decide.”

This transformation is especially pronounced in beauty, where consumers increasingly seek expert-like digital experiences. NielsenIQ’s 2025 Beauty Outlook reports a 40% year-on-year rise in AI-powered interactions, underscoring how quickly personalisation expectations are reshaping engagement.