The online share of sales made in health and beauty worldwide is set to rise to 16.5% post COVID-19 and by 2025 will surge to 23.3%, according to Edge by Ascential’s research and data insight arm Retail Insight.

Alibaba and Amazon investing in health and beauty

Worldwide, Retail Insight said health and beauty would see the second-fastest e-commerce growth after household and pet care in the coming years – largely driven by emerging participation from pure play retailers. Chinese e-commerce mogul Alibaba, for example, continued to add third-party health and beauty brands to its offering and American giant Amazon had invested heavily in healthcare provisions recently.

By the end of 2020, Alibaba will have generated €36.5bn ($43.2bn) in online health and beauty sales and Amazon will have totted up €24.3bn ($28.8bn), representing 6.1% and 6.2%, respectively, of the total health and beauty e-commerce global category.

The UK would witness the largest uplift in health and beauty e-commerce post-COVID, with sales growth set to accelerate 5% compared to an average uplift of 1.8% across all global markets, according to Retail Insight. China would follow next with a forecast uplift of 3.6% for online health and beauty sales.

“The rapidly developing digital outlook, coupled with the growing dominance of online players like Amazon and Alibaba, highlights how crucial it is to enhance omni-channel offerings and online capabilities,” said Florence Wright, senior retail analyst at Edge by Ascential.

Beauty promise with Alibaba and Amazon ‘scale’

Speaking to CosmeticsDesign-Europe, Wright said both Alibaba and Amazon were interesting platforms for beauty brands that wanted to stretch online presence in the Europe, Middle East and Africa (EMEA) region.

Alibaba’s “sheer size and scale” – set to serve two billion consumers globally by 2036 – made it “a must-win platform for brands looking to grow their international reach and visibility”, she said.

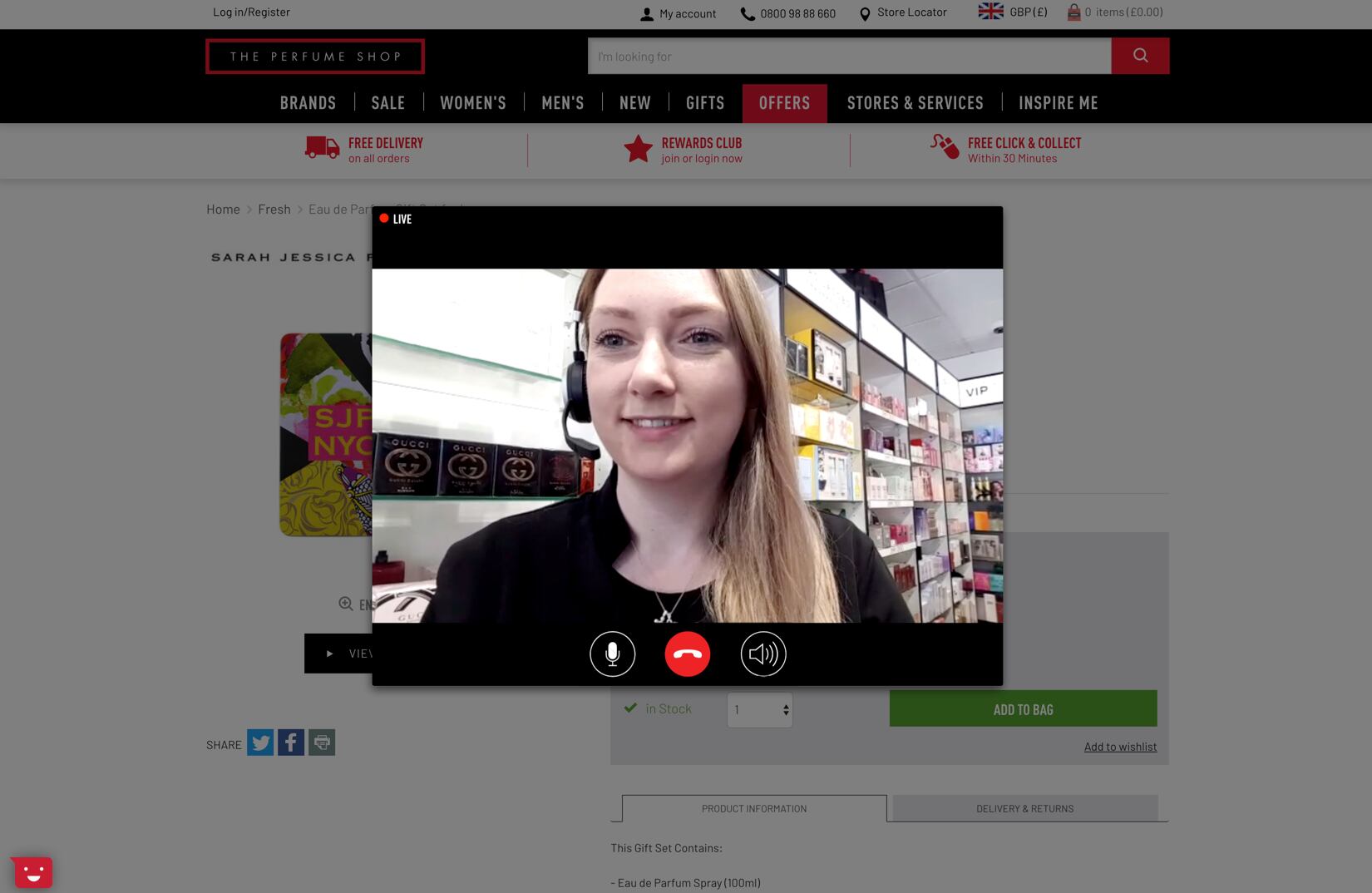

The appeal of Alibaba was that it was “more than just a sales platform, with an advanced and innovative approach to digital engagement”, she said, with options like livestreaming and augmented reality on its core platforms including Tmall, offering consumers “elevated levels of discovery and engagement”.

“…Online discovery still remains a key challenge for the beauty industry, and something which Western online platforms have generally lacked. This makes Alibaba an attractive partner for brands looking to test and learn new engagement strategies to scale elsewhere,” Wright said.

For beauty brands operating in the EMEA region, she said Amazon should also already be an important part of online strategies.

“With [Amazon’s] sales in EMEA set to total $99.6bn in 2020 – over three times the size of its next largest online competitor – its scale and reach offers obvious potential for brands looking to grow their e-commerce business, particularly in light of the accelerated shift to online caused by the pandemic.”

And whilst beauty remained a “relatively underdeveloped part” of Amazon’s overall retail business, Wright said it was an area it had been making headway in. It recently launched its own private label range and expanded an augmented reality partnership with L’Oréal, for example.

“Beauty brands with ambitions in e-commerce should be monitoring and considering Amazon as a key route to market.”

Digital transformation to ‘expand reach and boost growth’

Worldwide, Retail Insight data showed Walgreens Boots Alliance would continue to dominate as the leading health and beauty retailer in 2020, with total store-based and e-commerce sales reaching €110.2bn ($130.5bn) by the end of the year – up from €104.7bn ($124bn) in 2019 due to its pivot towards a digital transformation and online fulfilment following COVID-19.

Wright said: “With COVID-19 driving increased demand for health and beauty products, many retailers are planning further inroads into the category via enhanced online services and product lines.”

And as department stores experienced a drop of -10.9% in growth for 2020, she said “more beauty brands will be forced to diversity and focus on investing in online to expand reach and boost growth”.

Health and beauty brands had to implement “strong search optimisation” and “powerful online visual merchandising” when working on these platforms to better engage with consumers moving forward, Wright said.